Send Money to Nigeria

Transfer money safely (and instantly) to your loved ones in Nigeria with the AiDEMONEY app.

Each year, the Nigerian diaspora sends countless dollars to their loved ones back home. But how many of those money transfer fees support communities in Nigeria? It’s time to rewrite this story together. It starts with choosing AiDEMONEY, the app for Africans Funding Africa.

With AiDEMONEY, it’s never been easier to send money to Nigeria. Use our secure, streamlined app to transfer funds digitally, and trust our RegTech technology to safeguard your money every step of the way. Your loved one will receive your money via bank transfer or cash pickup — and an NGO doing great work in Africa will receive a portion of your money transfer fee.

Send money. Deliver progress. Join the movement today.

Send money to your loved ones instantly with a debit card or ACH bank account

Deposit money directly to your recipient’s bank account or schedule a cash pickup.

Have the confidence that you’re getting the best exchange rate, every time—no hidden fees or fine print

Transfer money safely and securely to Nigeria through AiDEMONEY’s blockchain-powered platform

Join a thriving community of Nigerian diaspora who are sending money, and progress, back home

AiDEMONEY has built strong financial partnerships across the African continent. What does that mean for you? Quick, secure ways to get money to your loved ones in Nigeria—all at industry-best rates.

Transfer money directly to your loved one’s bank account at Zenith Bank, Fidelity Bank, First City Monument Bank, Providus Bank or the United Bank of Africa.

Send money for cash pickup at First City Monument Bank locations across Nigeria.

Very easy to use and my brothers were able to collect the money on time. Also they received the rebate from their bank. N5 for every 7USD sent. I will recommend this app to anyone sending money to Africa. Going through the company website, I believe in their cooperate responsibility.

Very convenient and easy to use service. Plus the customer service was super when I contacted them.

Send money to your loved ones in seven easy steps.

Which countries can I send money to?

AiDEMONEY currently offers payments from the United States to Cameroon, Ethiopia, Ghana, Kenya and Nigeria. We’ll be enabling payments to more African corridors as our community grows. Want to transfer money to an African country not currently supported by our platform? Contact us.

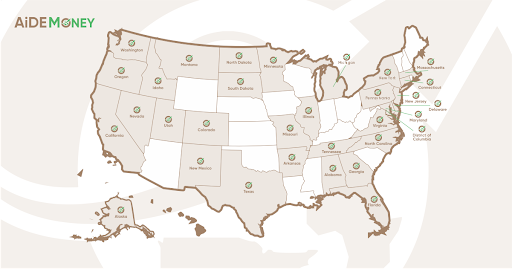

Which countries (and states) can I send money from?

AiDEMONEY is focused solely on money remittance from the U.S. to Africa. With our app, residents of the following U.S. states can initiate a money transfer.

Which payment methods can I use to send money?

Users can send money to their loved ones using either ACH or a debit card. When sending money via ACH, please make sure the bank account and sender names match. Our system supports debit card payments from the following card networks: Visa, Mastercard, Discover, American Express, STAR, Accel, Pulse, Culiance, Maestro and NYCE.

Which payout methods does AiDEMONEY support?

Your loved ones can receive a direct deposit to their bank account or mobile money network account. If you’re sending money to Nigeria, the recipient also has the option of cash pickup at First City Monument Bank.

For direct deposit, the sender will need to provide the following information about the recipient:

For cash pickup, you can either pre-select the payout location or allow the recipient to do so. When your recipient visits the cash payout location, he or she will need to present the following information:

How much money can I send via the AiDEMONEY app?

For added security, every customer is assigned a transaction limit when using the AiDEMONEY app. New customers are placed in Level 1. To request an increased limit, visit your user dashboard’s “Transaction Limit” page and provide the additional verification information required.

How long will it take for the recipient to receive my money transfer?

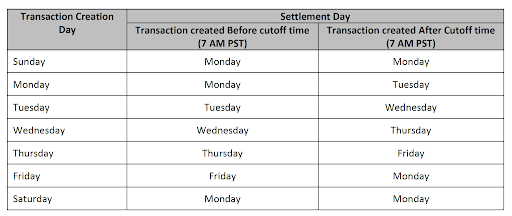

AiDEMONEY processes all debit card transactions by the end of the business day in which they were forwarded for processing. For ACH transactions, please refer to the cutoff times below.

At AiDEMONEY, we understand how important it is for your money transfer to arrive quickly. However, recent policy changes have caused delays in money remittances to Nigeria. If you have a question about the status of your transfer, please email our team at support@AiDEMONEY.com. We’re here to help.

Why is my transfer on hold?

AiDEMONEY’s platform uses robust security processes to keep our customers safe and our community 100% fraud-free. If you’re a first-time user, your account may be placed on a brief hold while we verify all the information you’ve provided about both yourself and your recipient. Once the process is complete, the hold will be lifted and your transfer will be initiated.

If you’re not a first-time user and your transfer has been placed on hold, this means that we’ve identified a concern during our compliance and regtech reviews. Sometimes, this could be due to a mismatch between the name of the sender and bank account holder. Other reasons for a “hold” include initiating a transfer with an IP address not located in a state supported by our platform; a failed balance check for the amount you’re sending; potential fraud; and other security red flags that require further review.

Have a question about a transfer marked “on hold?” We’re here to help. Please contact us for more information.

Love the look and feel. Works fast. Verification is through so it could take a sec but that in my opinion means more security which is awesome.