Frequently Asked Questions

AiDEMONEY is passionate about providing a safe, transparent money transfer service for the African diaspora and their loved ones back home. Review the frequently asked questions below for more information about our money remittance app. Still need help? Contact our team via chat, phone or email.

How do I send money with your app?

AiDEMONEY makes it easy to send money quickly, and safely, to your loved ones in Africa. Simply download the app on Android or iOS, or visit https://send.aidemoney.com/. From there, follow these simple steps to transfer funds digitally:

- Sign up for your free AiDEMONEY account

- Log into your account and tap “Send Money” to start your money transfer.

- Tell us how much money you want to send and to which country. We’ll show you the fees and how quickly your money will reach its destination.

- Provide details about your recipient and the desired delivery method.

- Provide details about the sender.

- Pay for your money transfer via bank account or debit card.

- Confirm your transfer details and send the payment.

- Receive an email confirmation with your transfer details and status.

Check your email and your AiDEMONEY account for updates every step of the way.

Which countries can I send money to?

AiDEMONEY currently offers payments from the United States to Cameroon, Ethiopia, Ghana, Kenya and Nigeria. We’ll be enabling payments to more African corridors as our community grows. Want to transfer money to an African country not currently supported by our platform? Contact us.

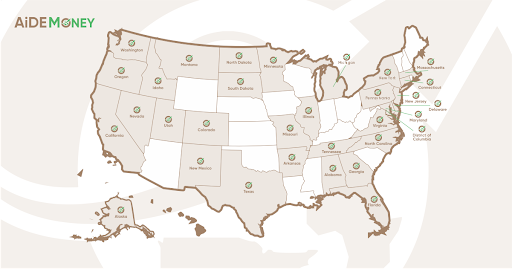

Which countries (and states) can I send money from?

AiDEMONEY is focused solely on money remittance from the U.S. to Africa. With our app, residents of the following U.S. states can initiate a money transfer.

- Alabama

- Alaska

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- District of Columbia

- Florida

- Georgia

- Idaho

- Illinois

- Maryland

- Massachusetts

- Michigan

- Minnesota

- Missouri

- Montana

- Nevada

- New Jersey

- New Mexico

- New York

- North Carolina

- North Dakota

- Oregon

- Pennsylvania

- South Dakota

- Tennessee

- Texas

- Utah

- Virginia

- Washington

How do I send money to Cameroon?

Download the app on the App Store or Google Play, or visit send.aidemoney.com. Then, send money securely to your loved one’s Wari or MTN mobile money account.

How do I send money to Ethiopia?

Download the app on the App Store or Google Play, or visit send.aidemoney.com. Then, send money securely to your loved ones in Ethiopia via HelloCash. Please note that your recipient must be registered for HelloCash at Cooperative Bank of Oromia (CBO) to receive money through the AiDEMONEY app. If your recipient is not registered with HelloCash, your money transfer could be delayed.

How do I send money to Ghana?

Download the app on the App Store or Google Play, or visit send.aidemoney.com. Using our app, you can send money to loved ones in Ghana with the following convenient payout options:

Direct deposit

Send money instantly and securely to accounts at Ghana’s most trusted banks:

- Access Bank

- Adom Savings and Loans

- Agricultural Development Bank

- ARB Apex Bank Limited

- Bank of Africa

- Bank of Baroda (GH) LTD

- Bank of Ghana

- ABSA Ghana

- BSIC

- Cal Bank

- Ecobank

- Energy Bank

- FBN Bank

- Fidelity Bank

- First Allied Savings and Loans

- First Atlantic Bank

- First National Bank

- GCB Bank

- GHL Bank Limited

- GN Bank

- Heritage Bank

- HFC Bank

- National Investment Bank

- Opportunity International

- Premium Bank

- Prudential Bank

- Royal Bank

- Stanbic Bank

- Standard Chartered Bank

- Unibank

- United Bank for Africa

- Universal Merchant Bank

- Zenith Bank

- Guaranteed Trust (GT) Bank

- Consolidated Bank Ghana Limited

- Republic Bank (Ghana) Limited

- Societe General (Ghana) Limited

Mobile money networks

Send money instantly and securely to Airtel Tigo, MTN or Vodafone.

How do I send money to Kenya?

Visit send.aidemoney.com, or download the app on the App Store or Google Play, Then, send money safely to recipients in Kenya via direct deposit or our supported mobile money networks.

Direct deposit

Send money instantly and securely to accounts at Kenya most trusted banks:

- Absa Bank

- African Banking Corp. Bank Ltd

- Bank of Africa Kenya Limited

- CFC Stanbic Bank of Kenya Limited

- Consolidated Bank of Kenya

- CRBD

- Credit Bank Limited

- Ecobank Limited

- Equity Bank Limited

- Family Bank Kenya Limited

- Guaranty Trust Bank (Kenya) Limited

- Gulf Africa Bank

- Gulf African Bank Limited

- Housing Finance Bank

- I&M Bank Limited

- IM Prepaid Card Account

- Imperial Bank Limited

- Jamii Bora Bank

- K-Rep Bank Limited

- Kenya Commercial Bank Limited

- Kenya Diaspora Sacco

- National Bank of Kenya Limited

- NCBA

- NIC Bank Limited

- NMB

- Prime Bank Limited

- SBM Bank Kenya Limited

- Spire Bank Limited

- Standard Chartered Bank Kenya Limited

- Trans-National Bank Limited

- UBA Bank Ltd.

Mobile money networks

Send money securely to your recipient’s MPesa account.

How do I send money to Nigeria?

Download the app on the App Store or Google Play, or visit send.aidemoney.com. Then, send money to loved ones in Nigeria with the following convenient payout options:

Direct deposit

Deposit funds directly to your recipient’s account. AiDEMONEY’s network includes Nigeria’s most trusted banks:

- Zenith Bank

- Fidelity Bank

- First City Monument Bank

- Providus Bank

- United Bank of Africa

Cash pickup

Send money for cash pickup at First City Monument Bank locations across Nigeria.

At AiDEMONEY, we understand how important it is for your money transfer to arrive quickly. However, recent policy changes have caused delays in money remittances to Nigeria. If you have a question about the status of your transfer, please email our team at support@AiDEMONEY.com. We’re here to help.

Which payment methods can I use to send money?

Users can send money to their loved ones using either ACH or a debit card. When sending money via ACH, please make sure the bank account and sender names match. Our system supports debit card payments from the following card networks: Visa, Mastercard, Discover, American Express, STAR, Accel, Pulse, Culiance, Maestro and NYCE.

Which payout methods does AiDEMONEY support?

Your loved ones can receive a direct deposit to their bank account or mobile money network account. If you’re sending money to Nigeria, the recipient also has the option of cash pickup at First City Monument Bank.

For direct deposit, the sender will need to provide the following information about the recipient:

- Recipient’s full name

- Name of recipient’s bank

- Name of the branch in which the account is located

- Recipient’s account number

- Recipient’s home address

For cash pickup, you can either pre-select the payout location or allow the recipient to do so. When your recipient visits the cash payout location, he or she will need to present the following information:

- Transaction reference PIN (emailed to the person who initiated the transfer)

- A valid ID

- If you’re picking up cash in Nigeria and are asked for information about the money transfer provider, please provide the name of our partner, Cashpot Limited (Afripay)

How can I pay for my transfer?

You can fund your transfers with a bank account or debit card.

How much money can I send via the AiDEMONEY app?

For added security, every customer is assigned a transaction limit when using the AiDEMONEY app. New customers are placed in Level 1. To request an increased limit, visit your user dashboard’s “Transaction Limit” page and provide the additional verification information required.

- Level 1

- Up to $500 per transaction

- Up to $500 per day

- Up to $1,000 per 15 days

- Up to $1,000 per 30 days

- Up to $3,000 per 6 months

- Level 2

- Up to $1,000 per transaction

- Up to $2,999 per day

- Up to $2,999 per 15 days

- Up to $5,000 per 30 days

- Up to $9,999 per 6 months

- Level 3

- Up to $2,000 per transaction

- Up to $3,000 per day

- Up to $6,000 per 15 days

- Up to $10,000 per 30 days

- Up to $30,000 per 6 months

Are there any transfer fees?

AiDEMONEY is committed to transparency, so you’ll always see your transfer fee before you click “send.” No surprises, no fine print. The transfer fee depends upon which country you’re sending money to and what amount you’re sending.

Questions? Our team is here to help you via live chat or email. Contact us anytime.

What is a guaranteed rate?

A guaranteed rate is an exchange rate that’s held for you—or guaranteed—for a specific period of time. Exchange rates with AiDEMONEY are guaranteed for 30 minutes. If you take longer than 30 minutes to complete your transfer request, you’ll receive a new rate.

What recipient information is required for a transfer?

The information required depends upon your transfer’s delivery method. For direct deposit and mobile money network accounts, you’ll need to provide the following details about your recipient:

- Recipient’s full name

- Name of recipient’s bank / mobile money network

- Name of the branch in which the account is located (for bank deposit only)

- Recipient’s account number

- Recipient’s home address

For cash pickup, your recipient will need to present the following information:

- Transaction reference PIN (emailed to the person who initiated the transfer)

- A valid ID

If your recipient is picking up cash in Nigeria and is asked for information about the money transfer provider, please provide the name of our partner, Cashpot Limited.

How long will it take for the recipient to receive my money transfer?

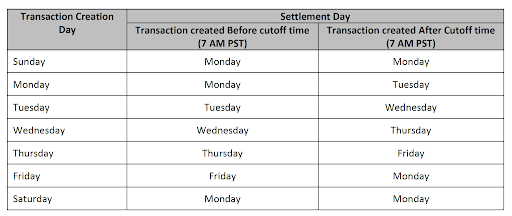

AiDEMONEY processes all debit card transactions by the end of the business day in which they were forwarded for processing. For ACH transactions, please refer to the cutoff times below.

At AiDEMONEY, we understand how important it is for your money transfer to arrive quickly. However, recent policy changes have caused delays in money remittances to Nigeria. If you have a question about the status of your transfer, please email our team at support@AiDEMONEY.com. We’re here to help.

How do I share transfer details with the recipient?

When you initiate a money transfer with AiDEMONEY, you’ll receive an email containing all the details of your transaction. This information is also available by logging into your AiDEMONEY client dashboard. Please share this information with your recipient—especially if you’ve selected cash pickup, as your email will include certain details the recipient must share when picking up the funds in-person.

How can I check the status of my transfer?

Simply log into your AiDEMONEY account to view your transfer status. If your transfer has been placed on hold, please read this FAQ for more information. Then, contact us with any additional questions regarding the status of your money transfer. (For the quickest response, please email support@AiDEMONEY.com or reach us via the website’s live chat.)

What does my transfer status mean?

Your transfer status refers to your request’s stage in our verification and approval process. Our transfer statuses include:

- Initiated: You’ve submitted your transfer and we’re in the process of verifying your account balance.

- Pending: We’ve completed our initial verification and your transaction is ready for processing.

- Processed: Your transaction is complete.

- Canceled: Your transaction has been canceled either because it did not pass our verification check or because the sender requested a cancellation before the transaction moved to “pending” status.

- Hold: Your transaction requires further review. (The most common reasons for “on hold” transfers include inaccurate sender or recipient information, and possible fraud flagged by our RegTech software.)

- Refunded: Your transaction has been refunded to the sender.

- Returned: Your transaction has been returned.

If you’ve opted for cash delivery, you might also see the following statuses: Delivery Requested (once we’ve submitted a request for cash delivery), Delivery Authorized (once the transaction has been verified for all compliance purposes), and Delivered (once your recipient has received the funds).

Have a question about your transfer status? Our team is here to help you via live chat or email. Contact us anytime.

Why is my transfer on hold?

AiDEMONEY’s platform uses robust security processes to keep our customers safe and our community 100% fraud-free. If you’re a first-time user, your account may be placed on a brief hold while we verify all the information you’ve provided about both yourself and your recipient. Once the process is complete, the hold will be lifted and your transfer will be initiated.

If you’re not a first-time user and your transfer has been placed on hold, this means that we’ve identified a concern during our compliance and regtech reviews. Sometimes, this could be due to a mismatch between the name of the sender and bank account holder. Other reasons for a “hold” include initiating a transfer with an IP address not located in a state supported by our platform; a failed balance check for the amount you’re sending; potential fraud; and other security red flags that require further review.

Have a question about a transfer marked “on hold?” We’re here to help. Please contact us for more information.

Can I view my transfer history?

To view your transfer history, sign in to your AiDEMONEY account and visit the “Transactions” section on the “My Account” tab.

What should I do if I send money to the wrong person?

If you’ve sent funds to the wrong recipient, please contact our team immediately via live chat or support@AiDEMONEY.com.

What should I do if I accidentally send the wrong amount of money?

If you’re reviewing your transaction details and realize you’ve sent the wrong amount of money, please contact us immediately via live chat or support@AiDEMONEY.com.

What should I do if I got my recipient’s information wrong?

During AiDEMONEY’s review process, we thoroughly check the details of both the sender and recipient. In most cases, our RegTech software will flag any discrepancies in your recipient’s information. If this occurs, we will notify you and request the information needed to verify your transfer. Once we’ve received and verified this information, your transaction will be completed.

If you notice that you have shared incorrect information about your recipient, please contact us via live chat or email at support@AiDEMONEY.com. Please have your transaction number ready as a reference.

What should I do if my recipient is having trouble collecting their cash pickup?

If your loved one in Nigeria is having trouble collecting their cash pickup, please make sure that they reference our local partner, Cashpot Limited, when requesting the funds at First City Monument Bank. This is AiDEMONEY’s sole cash pickup partner in Nigeria. If you’re still having issues with completing your cash pickup, please email support@AiDEMONEY.com or ping us on live chat.

How do I file a complaint or report an error?

We’re committed to exceeding your expectations for speed, transparency and impact. Have any issues? Please reach out to our team at support@AiDEMONEY.com. We’re here to help and will respond with the urgency that you deserve.

As a consumer, you have numerous protections when making money transfers. To contact the governing body in your state, please visit this page.

Can I send money to myself?

Yes, you can send money to yourself via the AiDEMONEY platform. However, keep in mind that your information must be verified as both the sender and recipient in order for your transfer to be completed. To avoid any delays in your money transfer, please make sure that all the information you provide is accurate.

Do I need to pay any tax on my money transfers?

No, you do not need to pay taxes on your money transfers.

Can I schedule transfers?

AiDEMONEY does not allow users to pre-schedule transfers. However, we’ve worked hard to streamline AiDEMONEY’s money transfer process so that our customers can send funds quickly and efficiently.